49+ can you deduct rental property mortgage payments

Get an Expert Opinion2nd Opinion. However any value between 500000 - 1000000 must have a 10.

What Is The Take Home Salary For A Ctc Of 10 Lpa For 2022 2023 Fy Quora

For 2021 the standard mileage rate for business use was 585 cents per.

. Actual expenses or the standard mileage rate. You should have rental income after direct expenses insurance and property taxes and you can. Web Do we treat mortgage payments on business property as a monthly expense or do we depreciate the entire mortgage as a capital expense.

Web You can deduct travel using two methods. Report the amount of mortgage interest paid on your rental property on line 12 of IRS Schedule E assuming that the mortgage is from a financial institution like a bank. Web As a rule of thumb a rental property owner can deduct interest payments made to acquire or improve a rental property.

When you include the fair market value of the property or services in your rental income you can deduct that same amount as a rental expense. Web Owning a rental property can return cash and tax advantages. Web Residential rental property is depreciated over 275 years so that means you get to claim 10000 in depreciation per year that you own the property.

You do not treat the. In general you can deduct mortgage insurance premiums in the year paid. Common tax-deductible interest expenses.

Web The interest you pay is income to the lender however on which the lender must pay income tax -- because the lender pays the income tax on this portion you can deduct it. Ask Online Right Now. Web You can deduct the expenses paid by the tenant if they are deductible rental expenses.

However if you prepay the premiums for more than one year in advance for. Ad Real Estate Family Law Estate Planning Business Forms and Power of Attorney Forms. Ad Get Streamlined Access and Unlimited Legal Questions.

Dont Take Chances w the Law. Web Taxpayers must recover the cost of rental property through an income tax deduction called depreciation. This annual allowance accounts for a propertys wear.

Web Taxpayers cannot deduct residential rent payments on your federal income taxes. Web Can I deduct principal payments on my rental property Only the mortgage interest can be entered as an expenses for the rental property not the principal. Web You can pay a minimum 5 down payment on the first 500000 in value of your property.

Get Access to the Largest Online Library of Legal Forms for Any State. But depending on where you live you might be able to deduct a portion of rent. Web You cannot deduct principal mortgage payments from your income whether your real estate property is your primary residence or a rental property.

Solved Consider The Buy Vs Rent Excel Spreadsheet Chegg Com

424h

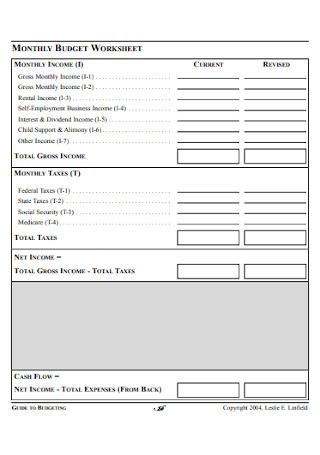

Free 49 Budget Forms In Pdf Ms Word Excel

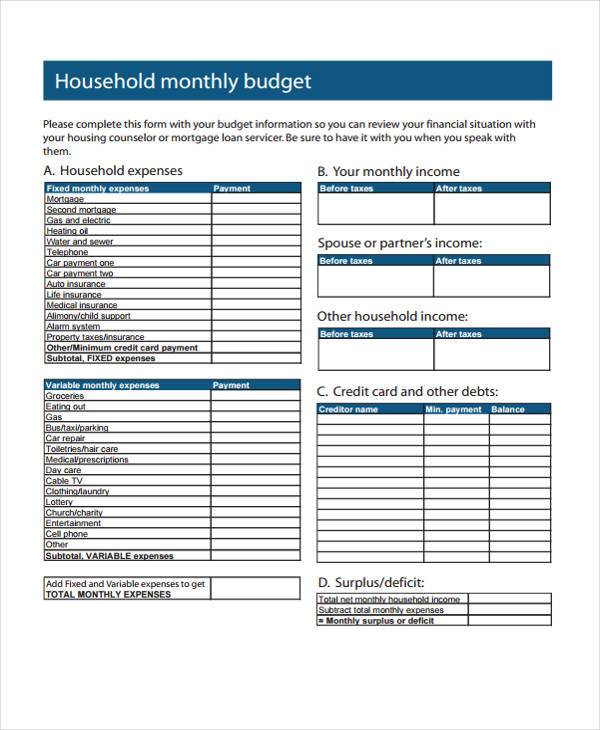

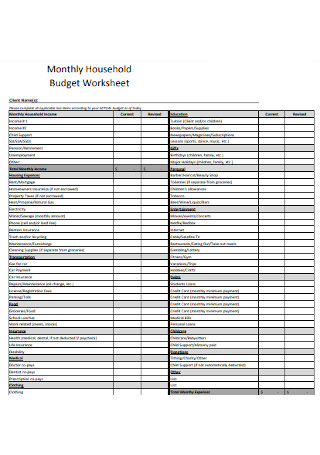

49 Sample Monthly Budgets In Pdf Ms Word

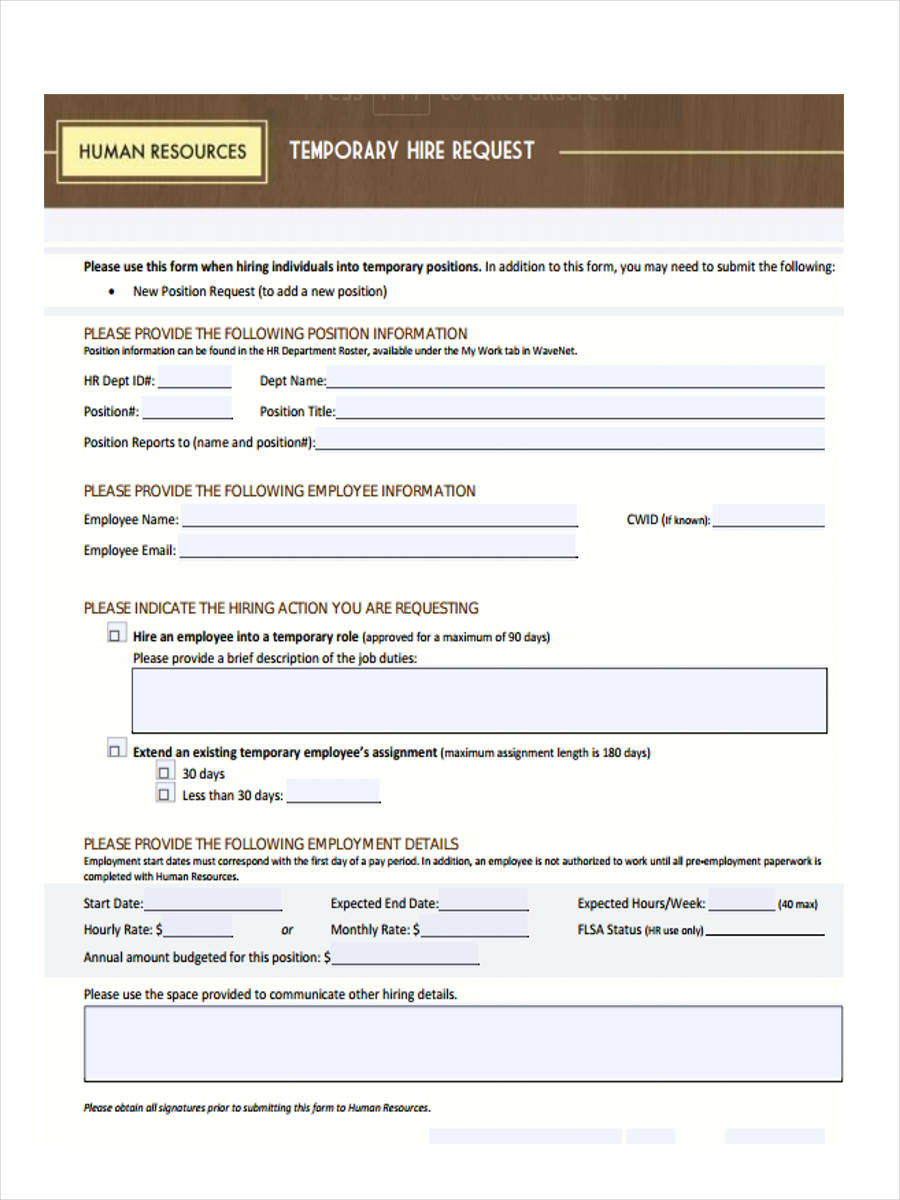

Free 49 Sample Employee Request Forms In Pdf Ms Word Excel

Income Verification Letter 9 Examples Format Sample Examples

Sgd Inr 50 With Sg 50 Aditya Ladia

Fuel Cell Technologies Market Report 2014

Nord Lb Group Annual Report 2007 Pdf 1 8

424h

Can You Write Off Loan Payments From A Rental Property

Russian Bazaar 790 June 9 By Russian Bazaar Newspaper Issuu

Home Affordability Calculator For Excel

49 Sample Monthly Budgets In Pdf Ms Word

9 Rental Property Tax Deductions For Landlords In 2022 Smartasset

Is Your Mortgage Considered An Expense For Rental Property

Free 49 Budget Forms In Pdf Ms Word Excel